What I Wish I Learned in School 1 of 12: Compound Interest

If there’s one financial concept that has the power to change lives, but is underappreciated, it’s compound interest. For most of us, compound interest wasn’t covered in school, leaving us to stumble upon its magic later in life. And it’s sometimes too late for us to fully benefit from its power. Here’s why understanding compound interest early could make all the difference.

What is compound interest?

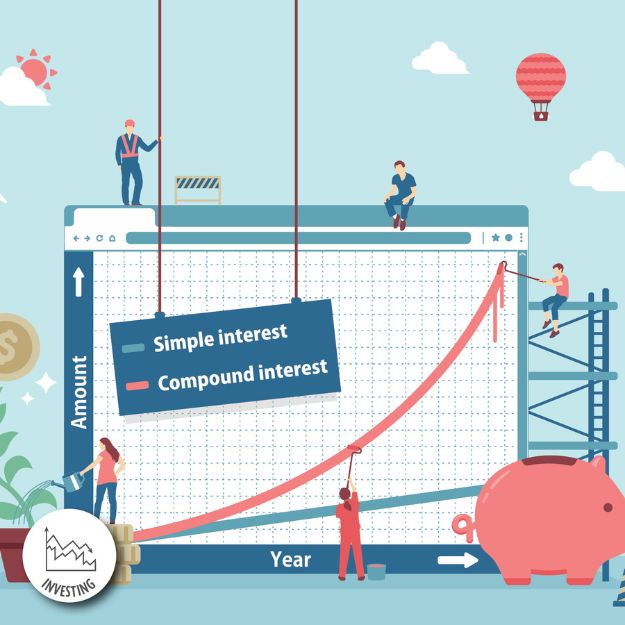

Compound interest is the process of earning interest on both the initial principal of an investment and the accumulated interest over time. In other words, your money makes money, and that money makes more money, too. Compound interest has tremendous potential to grow wealth when applied consistently over time.

An example of compound interest

Imagine you invest $1,000 at a 5% annual interest rate. If the interest is simple (not compounded), you earn $50 annually. After 10 years, you have about $1,500. But, with compound interest, you earn interest on the $1,000 in year one, then on $1,050 in year two, and so on. After 10 years, your $1,000 grows to $1,628.89 — not because the rate is higher, but because of the compounding effect.

Why timing matters

Compound interest thrives on a single crucial element: time. The earlier you start saving or investing, the more exponential the growth.

For example, investing $200 a month at age 25, with an annual return of 7%, will net you nearly $480,000 by age 65. If you start the same plan at age 35, you’ll only have approximately $227,000 by age 65,

Lessons on compound interest you wish you’d learned in school

Here are the most important principles of compound interest:

1. Start early, even with small amounts. Compound interest needs time to work its magic, and even a small amount of investing early in life could lead to significant returns over time.

2. The Rule of 72. Divide 72 by your annual interest rate, and you’ll get the number of years needed for your investment to double. Learning this trick early can inspire better saving habits.

3. Compounding works for debt, too. Credit card debt, for example, compounds at alarming rates, turning small balances into financial nightmares.

4. Harness the power of automation. Setting up automatic transfers to savings or investment accounts ensures consistent contributions and removes the temptation to spend.

Why understanding compound interest can be life-changing

Understanding the concept of compound interest can truly be life-altering. Here’s why:

- Increased financial freedom with robust investments.

- Less stress in emergencies, thanks to fast-growing savings.

- Early start on retirement savings, ensuring years of growth.

How to make up for lost time

It’s not too late to start harnessing its power. Here are a few steps to get going:

- Open a high-yield savings account or start investing.

- Take advantage of employer-matched funds in retirement accounts.

- Automate your savings to ensure consistency.

- Educate yourself to better understand how compounding works.

Learning to harness the unique power of compound interest can make all the difference to your financial health.