Author: Abigail Siebert

Football Season Is Back and So Are Sports Betting Scams

What You Need to Know to Protect Your Wallet This Season

Football is back, and so is the excitement that comes with game days, fantasy leagues, and sports betting. But as more people place bets online, scammers are getting in on the action too. They’re targeting fans with schemes designed to steal money and personal information.

At High Point FCU, we want to help you enjoy the season without falling victim to fraud. Here’s what to watch out for, and how to stay protected.

Common Sports Betting Scams to Watch Out For

1. Fake Betting Apps and Websites

Fraudsters are creating realistic-looking websites and mobile apps that mimic legitimate sportsbooks. These sites often disappear once they’ve collected deposits, leaving users with no way to recover their money.

2. Social Media Tipster Scams

Beware of “insider” betting advice or paid picks from self-proclaimed experts on social media. Many of these accounts are fake, and once they receive payment, they vanish or push you toward fraudulent betting sites.

3. Phishing Emails and Texts

Scammers may send fake emails or texts claiming you’ve won a bet or need to verify your account. These messages often contain links designed to steal your login credentials or financial information.

4. Crypto-Only Betting Platforms

Some unregulated sites ask users to deposit cryptocurrency to place bets. These transactions are difficult to trace, and if the platform is a scam, recovering your funds is nearly impossible.

5. Impersonation Scams

Scammers may pose as customer service agents from popular betting apps, requesting personal information or payment to resolve a fake issue. Legitimate companies will never ask for sensitive data via text, direct message, or unexpected phone calls.

How to Bet Safely This Season

If you choose to participate in sports betting, it’s important to take precautions:

Use Licensed and Regulated Platforms

Always use sports betting sites that are legal in your state. Most state gaming commissions have lists of approved operators.

Avoid Untraceable Payments

Never send money using cryptocurrency, wire transfers, gift cards, or peer-to-peer apps unless you’re confident in the platform’s legitimacy and consumer protections.

Enable Account Alerts

Use your credit union’s mobile app or online banking tools to receive real-time alerts about purchases or suspicious activity.

Don’t Share Personal Information

Never provide your debit card PIN, online banking credentials, or Social Security number to someone claiming to be from a betting site or financial institution.

Use Strong Passwords and Two-Factor Authentication

Secure your devices and online accounts with strong passwords and two-factor authentication whenever possible.

We’re Here to Help

If you believe your information or account has been compromised, contact High Point FCU immediately. Our team can help you secure your accounts and guide you through the necessary steps to report fraud.

Scammers are always looking for new ways to take advantage, but with awareness and the right precautions, you can stay one step ahead.

Need help or have questions?

Stop by any of our branches, call us at 800-854-6052, or connect with us online for more information.

Stay safe and enjoy the football season!

What I Wish I Learned in School About Money Management 8 of 12: The Basics of Investing

Everyone dreams of becoming an investor but taking that first step into the market can feel overwhelming. Where should you begin? Which investments align with your goals?

So many questions, and we’ve got answers! Here’s what you need to know about investing to get started.

What is investing?

At its core, investing means putting your money into something with the expectation that it will grow in value over time. Investments can take many forms, including:

- Stocks-shares of ownership in a company.

- Bonds-loans you give to governments or corporations in exchange for interest.

- Mutual funds-pools of money from many investors used to buy a mix of stocks and bonds.

- Exchange-traded funds (ETFs)-similar to mutual funds but traded like individual stocks.

- Commodities-like gold or oil.

- Real estate-whether commercial or residential

Why invest?

Investing is crucial for long-term financial growth. Here’s why:

- Beat inflation. Investing helps your money grow at a rate that can outpace inflation.

- Build wealth. Consistent investing — even in small amounts — can add up over time thanks to compound interest, where you earn returns on your original investment and the returns you’ve earned.

- Reach financial goals. Whether you’re saving for retirement, a home or your child’s education, investing can help you get there faster than by saving alone.

Types of investments: the big three

- Stocks. When you buy a stock, you’re buying a piece of a company. If the company performs well, the stock’s value may rise, and you will likely get dividends, or a share of the company’s profits. Stocks can offer high returns, but they come with higher risk.

- Bonds. Bonds are generally more stable. When you buy a bond, you’re essentially lending money to a company or the government. In return, they promise to pay you back with interest.

- Mutual funds and ETFs. These are collections of investments managed by professionals (mutual funds) or following an index (ETFs). They offer diversification, which spreads out your risk by investing in several companies or sectors at once.

Risk and reward: finding the balance

Every investment carries risk, which means you can lose money. Generally, the higher the potential reward, the greater the risk. Your risk tolerance depends on factors like your age, financial goals, time horizon (when you’ll need the money) and your personal comfort with market fluctuations.

The power of compound interest

One of the most powerful forces in investing is compound interest. Let’s say you invest $1,000 and earn a 7% annual return. After one year, you’ll have $1,070. The next year, you earn interest on $1,070 — not just your original $1,000. Over time, that snowball effect can lead to massive growth.

Getting started

Here’s how to jump into the world of investing in five easy steps:

- Clarify your goals.

- Build an emergency fund first with three to six months’ worth of expenses saved.

- Start with tax-advantaged accounts, like a 401(k), IRA or Roth IRA.

- Choose a platform. You can invest through a brokerage account like Fidelity, or a robo-advisor like Betterment.

- Start small and stay consistent — even $50 a month adds up.

Investing tips for beginners

- Diversify. Spread your investments across different asset classes and markets.

- Think long-term. Expect fluctuations in the market and don’t panic over short-term drops. They rarely affect your overall net gain.

- Avoid trying to time the market. No one can predict exactly when to buy or sell. Time in the market usually beats timing the market.

- Stay educated. Read books, follow financial blogs and/or listen to podcasts on investing to deepen your understanding.

Start now, stay steady and watch your money grow.

Common Summer Scams and How to Avoid Them

Don’t get scammed this summer! Here are some of the most common summer scams and how to avoid them.

Travel scams

In these scams, fraudsters target vacationers with offers that are too good to be true. They’ll promote bogus travel sites with incredibly low prices on rentals, but when the victim travels to the alleged rental, they’ll find it doesn’t exist.

Red flags:

- “Free vacation” offers

- Ridiculously low-priced getaways

Stay safe: Only book your vacations through reputable travel sites and platforms. Before reserving, verify the property address online and run the photos through a reverse-image search. Pay via credit card for purchase protection.

Online shopping scams

Here, scammers create copycat shopping websites or fake social media stores selling seasonal gear at huge discounts They may lure you with aggressive email campaigns, fake security alerts and/or spoofed “order confirmation” messages.

Red flags:

- URLs with spelling errors and typos

- Emails that use urgent or threatening language

- “Verification” requests for account details you didn’t initiate

Stay safe: Only shop trusted sellers and platforms. Check for a padlock symbol and review the URL’s spelling of each landing page. Never pay by wire transfer or gift card when making a purchase. If you get an unexpected package notification or account alert, don’t click any links; instead log into your account directly or call the company using a verified number.

Event ticket scams

Concerts, sports games and festivals are summer staples, and scammers know it. Fake or counterfeit tickets are sold on shady sites and through social media posts, with fraud sales peaking in the summer.

Red flags:

- Unsolicited offers for tickets

- Online listings for extra “Hot Concert” tickets for a fraction of face value

- Requests to pay by cash or bank transfer

Stay safe: Only buy tickets from the venue box office, official promoter or verified resale sites. Use a credit card to pay, if possible.

Door-to-door scams

In these scams, fraudsters knock on doors and offer various home repairs on the spot. They’ll pressure the target with scare tactics like, “Our crew is leaving town tomorrow” or claim to have extra materials “left over.”

Red flags:

- “Contractors” without proper licensing or permits

- Door-to-door workers offering super-cheap work

Stay safe: Verify credentials before you hand over your personal info, cash or credit card. Ask for references before hiring and get a complete written estimate of the cost.

If you’ve been scammed

If you believe you’ve been scammed, take action quickly. Contact your credit union or credit card company to report any fraudulent charges and request a reversal. If you paid via a wire transfer or money app, notify the wire company and if gift cards were used, contact the card issuer to explain the fraud. Change any passwords that may have been compromised.

Next, file a report with the FTC and let local law enforcement agencies know about the scam. If you shared sensitive information, visit IdentityTheft.gov for step-by-step guidance.

Stay safe!

What I Wish I Learned in School: How to Manage Debt

Carrying ongoing debt can bring many challenges. The person is often stuck paying high interest rates. This, in turn, can prompt the debtor to only pay the minimum amount due each month. And that means making little headway on the actual balance. As time passes, they’ll keep acquiring new debt and keep falling deeper into the trap.

The good news is, it doesn’t have to be this way. With the right tools and information, you can learn to manage, and ultimately, eliminate your debt.

Here are nine steps for managing your debt and paying it down.

1. Organize your debt

First, list all your debts. Include credit cards, student loans, auto loans and any other outstanding balance you may carry. For each debt, note the following:

- Total amount owed

- Interest rate

- Minimum monthly payment

- Due date of monthly payment

Tally up your total debt monthly payments. Then, list your debts in order of interest rates, and then in order of outstanding balances.

2. Create a realistic budget

Track your income and expenses for several months. Then, set aside a reasonable amount for each spending category, ensuring you can adequately cover all of your monthly expenses. Finally, review your spending and look for ways you can increase your income and/or trim your expenses in any manner. Allocate these extra funds toward your debt payments.

3. Choose your debt payoff strategy

You have two primary choices here:

- The avalanche method. Here, you’ll start with the debt that has the highest interest rate or highest balance, and maximize payments toward paying it off, then move on to the next until you’re debt-free.

- The snowball method. In this method, you’ll pay off the smallest debt first, and then work through the rest in ascending order.

Review each strategy carefully and choose the one that best aligns with your lifestyle.

4. Consider debt consolidation

If you’re dealing with a large amount of debt, you may want to consider debt consolidation. This involves combining multiple debts into a single loan with a lower interest rate. Doing so will simplify debt management by giving you just one monthly payment to manage, and can potentially lower overall interest paid, too.

5. Avoid accumulating additional debt

Limit the use of credit cards and refrain from financing new purchases while working on paying off debt. It may be helpful to destroy your credit cards and have your personal devices “forget” your credit card information so you don’t spend mindlessly.

6. Seek professional advice

If managing debt becomes overwhelming, consider consulting a financial advisor or credit counseling service. It’s important to verify any service you use by checking for an online presence, reading customer reviews, demanding complete transparency and being wary of any service that demands upfront payment and/or promises outrageous results.

7. Monitor your credit

It’s wise to review your credit usage on a regular basis, and this is especially relevant when you’re working toward paying down debt. You can obtain free credit reports once a year from each of the three major credit bureaus and check your score on sites like CreditKarma. It’s also important to review your monthly credit card statements for fraud.

8. Build an emergency fund

Having an emergency fund can prevent the need to incur additional debt during unforeseen circumstances. Aim for a fund amounting to three to six months’ worth of living expenses.

9. Stay committed and patient

Celebrate small victories along the way to stay motivated. Consistency and perseverance are the keys to achieving financial freedom.

Follow these tips to learn how to manage and pay down your debt for good.

Don’t Get Hooked: How to Recognize and Avoid Phishing Scams

Don’t get caught in a phishing scam! Here’s how to stay safe.

What is phishing?

Phishing is a cybercrime where scammers use deceptive messages to steal victims’ personal information. These messages can impersonate well-known companies, government agencies, celebrities or even people the victim knows. The goal is to create a sense of urgency, fear or curiosity, which often dupes people into clicking a malicious link or providing confidential details.

There are several ways phishing scams play out, including fake emails or texts from banks or credit unions, phone calls posing as tech support, messages pretending to be from a delivery service with links to “track your package” and fraudulent text alerts about unusual activity on your accounts.

Let’s take a closer look at the three most common variations of phishing scams.

1. Email phishing

Email phishing is the most common type of phishing scam. In this ruse, criminals send fraudulent emails that look trustworthy and encourage you to click a link or download an attachment. For example, an email that appears to be from your credit union or bank may instruct you to verify your account by clicking a link and logging in. Unfortunately, the link leads to a fake website where your credentials are stolen.

Red flags to watch for:

- Urgent language

- Generic greetings

- Suspicious email addresses

- Spelling and grammar errors

- Unexpected attachments

2. Vishing (voice phishing)

In vishing scams, scammers call victims and pretend to be legit representatives, often pressuring the victim into providing sensitive information. For example, a scammer calls, claiming to be from your credit union’s fraud department. They’ll tell you your account has been compromised and will ask for your PIN to secure it.

Red flags to watch for:

- Unsolicited calls

- Requests for personal info

- High-pressure tactics

- Spoofed numbers

3. Smishing (text phishing)

Smishing uses text messages to trick victims into clicking on malicious links or sharing private information. For example, a text claims there’s a problem with your delivery and asks you to click a link to update your shipping details. The link leads to a fraudulent site.

Red flags to watch for:

- Unexpected texts

- Links to unfamiliar websites

- Grammatical errors

- Too-good-to-be-true offers

How to protect yourself

Here’s how to defend yourself from a phishing attack:

- Think before you click. Don’t click on links or download attachments from unknown sources.

- Verify the source. Contact the organization directly using official contact information, not what’s provided in the message.

- Enable multi-factor authentication (MFA). Add an extra layer of security to your accounts.

- Inspect URLs. Before choosing to click or not, hover over links to check for inconsistencies.

- Avoid sharing sensitive information. Legitimate organizations won’t ask for passwords or personal details by email, text or phone.

- Use antivirus software. Keep your devices protected and ensure your software is updated.

- Educate yourself. Learn to recognize phishing attempts and stay informed about the latest scams.

Stay safe!

First-Time Home-Buyer’s Checklist

Buying your first home is exciting and challenging. To make it easy for you, we’ve put together a comprehensive checklist to guide you through the home-buying process.

1. Get your finances in order

Before you can think about buying a house, ensure your finances are up to par. Several months before you start your search, review the following:

- Your income. You’ll need to demonstrate a consistent and reliable income source to lenders.

- Credit score. Your credit score significantly influences your mortgage eligibility and interest rates.

- Debt-to-income (DTI) ratio. Calculate your DTI by dividing your monthly debt payments by your gross monthly income.

It’s also a good idea to start gathering the documents you’ll need:

- Two years’ worth of W-2s

- Profit & loss statement, if self-employed

- Pensions and Social Security check stubs

- Proof of child support payments

- Copies of alimony checks

- Statements for all checking and savings accounts

- Car loan information

2. Determine your budget

Calculate your current monthly expenses by listing all your recurring bills excluding your current rent payments. Include debts, groceries and entertainment expenses and then see how much room you have left in your budget for a monthly mortgage payment. Be sure to budget for ongoing household expenses, too.

3. Prepare your down payment

Next, be sure you have the funds prepared for a down payment. While a 20% down payment is traditional, there are various loan programs that allow for lower percentages. However, smaller down payments might require private mortgage insurance (PMI).

4. Assemble your real estate team

Look for a real estate agent who can provide market insights, negotiate on your behalf and guide you through the buying process. You’ll also need a mortgage broker and/or lender to help navigate various loan options and find the best rates. In some states, you’ll need a real estate attorney as well.

5. Get pre-approved

A mortgage pre-approval, which indicates the loan amount you’re approved for, strengthens your position as a serious buyer. Present your prepared documents to your chosen mortgage broker or lender and let them know how much you plan to spend on your new home. If everything is in order, you should receive your pre-approval letter within a few days.

6. Start house hunting

You’re ready to start your search!

Identify your must-haves, which can be deal-breakers, and the things you’d like to have in your new home. Consider factors like location, size and amenities. Explore different neighborhoods, attend open houses and monitor market trends.

7. Make an offer

Next, work with your agent to determine a base offer and have the home inspected to identify potential issues, from structural problems to necessary repairs. The home will also need to be professionally appraised at this time.

9. Secure financing

During this time, you’ll also need to finalize your financing. Be sure to submit all required documents to your lender in a timely manner. You’ll also need to decide when to lock your interest rate, considering market conditions. Finally, review the loan estimates to ensure you understand all costs associated with your mortgage.

10. Prepare for closing

As the closing date approaches, you’ll need to perform some final tasks:

- Final walk-through. Inspect the property to ensure it’s in the agreed-upon condition.

- Look over the closing document,, which outlines your loan terms, monthly payments and closing costs.

- Arrange funds for closing.

11. Close on your new home

You’re ready for the final step in the purchase of your new home: the closing! Be prepared to sign multiple documents, including the deed of trust, promissory note and closing disclosure. Once all documents are signed and funds are transferred, you’ll receive the keys to your new home.

12. Post-closing tasks

After the closing, you’ll need to transfer or establish accounts for electricity, water, internet and other essential services. Decorate and refresh the home according to your taste. Now all that’s left to do is pack up and move in!

Follow this checklist to navigate the homebuying process with ease.

What I Wish I Learned in School 6 of 12: Avoiding Lifestyle Creep

Most people assume that they’ll start saving and investing a lot more money if their income were to increase. But, what actually happens after that raise is that their savings percent doesn’t budge and they have no idea where the extra money is going. This is usually due to lifestyle creep. Let’s take a look at this phenomenon, why it happens and how you can avoid it to maintain a life of financial fitness.

What is lifestyle creep?

Lifestyle creep, also known as lifestyle inflation, is when people’s monthly expenses increase along with their income. Unchecked lifestyle creep can ruin long-term financial goals, leaving people in a cycle where higher earnings don’t translate to increased savings or financial security.

Recognizing the signs

Here are some signs that you may be caught in lifestyle creep:

- Stagnant savings. Despite earning more, your savings or investment accounts aren’t growing.

- Increased debt. You’re consistently taking on more debt to finance a more lavish lifestyle.

- Frequent upgrades. You’re constantly upgrading things even though the current model is fully functional.

- Tight budget. You’re always running low on money by the end of the month despite an increase in income.

Strategies to avoid lifestyle creep

Follow these tips to stay financially fit under any circumstance:

- Establish clear financial goals. Long- and short-term financial goals will help keep you on track.

- Create and stick to a budget. Develop a detailed monthly budget that assigns a dollar amount for each spending category. Review and adjust your budget regularly.

- Limit your revolving credit. It’s best to keep your credit limit down, even with an increase in your income.

- Automate savings and investments. Set up automatic monthly transfers to your savings account.

- Mindful spending. To avoid buyer’s remorse, implement a waiting period for significant purchases, such as a 48-hour rule, to determine if the expense is really necessary.

- Regular financial audits. It’s a good idea to review your financial statements on a regular basis to see where you may be overspending.

- Resist social pressures. Instead of trying to match or outdo online personalities, create your own personal and financial goals, a realistic plan for achieving them and then go and get ‘em!

- Live below your means. Even with a higher income, it’s best to spend less than you earn.

Use these tips for active steps you can take to prevent and avoid lifestyle inflation.

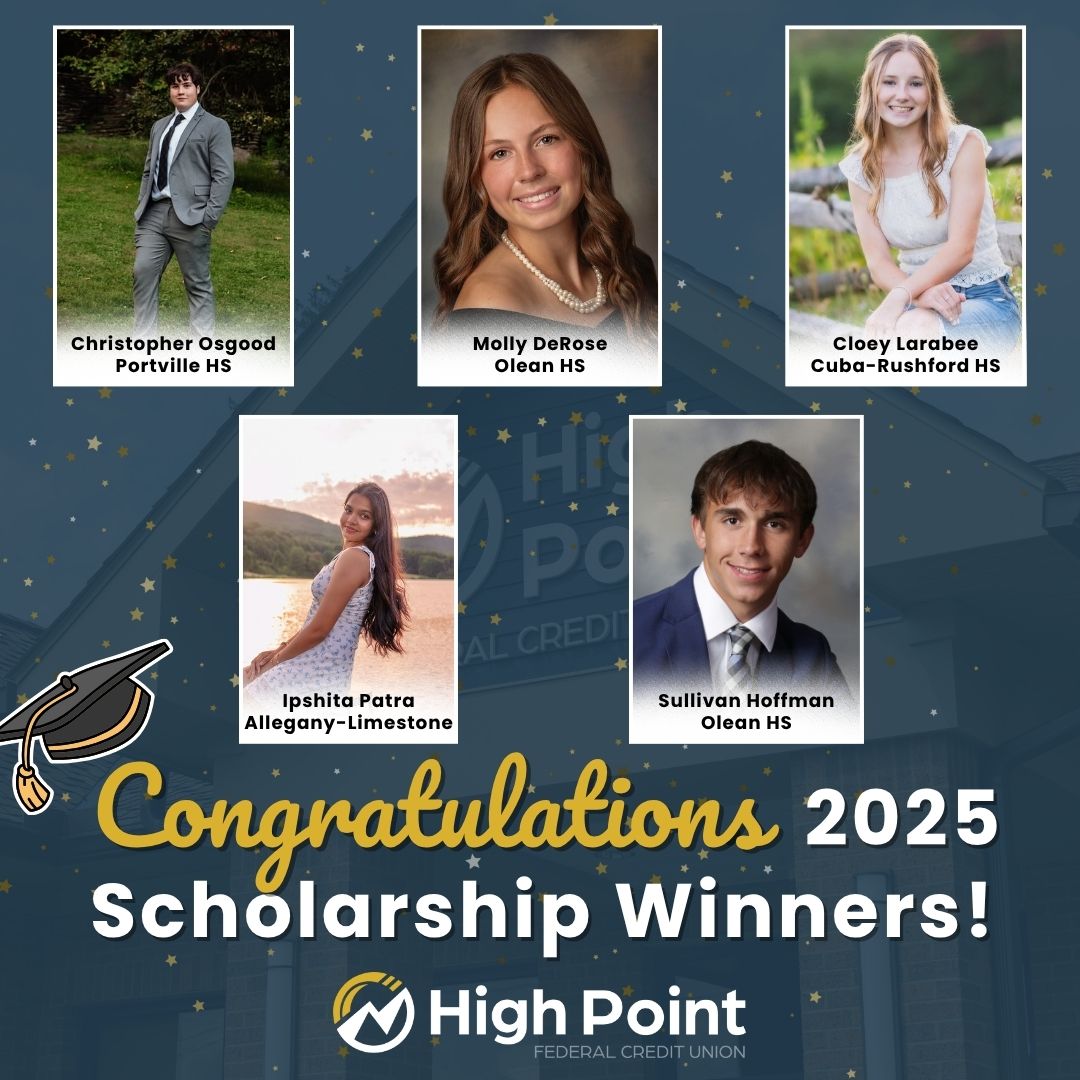

High Point Federal Credit Union Awards Scholarships to Collegebound Seniors

Olean, NY – High Point Federal Credit Union has granted $2,500 in college scholarships to five high school seniors to assist them in funding their higher education.

The recipients, who are members of High Point FCU, were selected based on their exceptional academic and extracurricular accomplishments.

Richard Yeager, CEO, spoke about how meaningful it is each year to meet the scholarship recipients and celebrate their hard work and potential. He shared that these moments truly reflect the credit union philosophy of ‘people helping people’, a reminder of the impact that comes from supporting one another and investing in our communities.

The high school seniors who were honored with the scholarships include Sullivan Hoffman and Molly DeRose from Olean High School, Ipshita Patra from Allegany-Limestone High School, Cloey Larabee from Cuba-Rushford High School, and Christopher Osgood from Portville High School.

High Point FCU is the second largest credit union in Western New York, with assets over $400 million. The credit union currently serves over 21,000 members with four locations, 1201 Wayne Street and 206 North Clark Street in Olean, 180 West Main Street in Allegany, 160 S. Main Street in Portville, and 1035 East Main Street in Bradford.

What’s the Difference Between a Home Equity Line of Credit and a Home Equity Loan?

If you’re looking to tap into your home’s equity, you have two great choices in a Home Equity Line of Credit (HELOC) and a Home Equity Loan (HEL). Let’s take a look at these two options, the key features of each and factors to consider before making a decision.

How are HELOCs and home equity loans used?

Although they are structured differently, HELOCs and home equity loans are generally used for similar purposes:

- Home renovations

- Debt consolidation

- Emergency expenses

- Large purchases

- Business launch or growth

What Is a Home Equity Line of Credit (HELOC)?

A HELOC features a revolving line of credit that the homeowner can draw from as needed. The borrower can use funds up to a predetermined limit and repay them over time, often only paying interest on the borrowed amount.

Key features of HELOCs:

- Revolving credit. Homeowners have access to a line of credit that can be drawn upon repeatedly during the “draw period,” which tends to last five to 10 years.

- Variable interest rate. HELOCs often have variable rates, which means the interest rate can change based on market conditions. Because of this, monthly payments can fluctuate throughout the HELOC term.

- Flexible repayment. Borrowers have the flexibility to pay off the balance and then re-borrow funds during the draw period.

- Interest-only payments initially. Many HELOCs allow interest-only payments during the draw period, making initial payments lower.

What is a home equity loan?

A home equity loan is a loan that’s borrowed against your home’s equity. Your home’s equity is calculated as the difference between the current market value of the home and the outstanding balance on the mortgage.

Key features of home equity loans:

- Lump sum disbursement. Borrowers receive the full loan amount all at once.

- Fixed interest rate. Most home equity loans come with a fixed interest rate.

- Set repayment terms. The loan is repaid over a predetermined period, which typically ranges from five to 30 years.

- Predictable payments. Borrowers know exactly how much they’ll pay throughout the life of the loan, making budgeting for the loan easy.

Key differences between HELOCs and home equity loans

Understanding the differences between these two products is crucial for deciding which is right for you.

1. Disbursement of funds:

- HELOCs offer a revolving line of credit that can be drawn as needed. This makes them ideal for homeowners who don’t know exactly how much they need to borrow.

- Home equity loans provide a one-time lump sum, making them the perfect choice for borrowers who know exactly how much they want to borrow and need the funds right away.

2. Interest rate structure:

- HELOCs generally have a variable interest rate, which can fluctuate with market conditions. This can mean having a lower monthly payment at times, but it can also lead to rising payments.

- Home equity loans typically come with a fixed interest rate, which means there are no surprises throughout the life of the loan. This can mean significant savings for the borrower if interest rates rise, with the inverse occurring if rates drop.

3. Repayment terms:

- HELOCs feature flexible payment terms during the draw period. However, payments may vary once principal repayments begin.

- Home equity loans have a fixed repayment period with predictable monthly payments.

Whichever home equity product you decide on, you’re assured favorable interest rates, easy eligibility and the personalized service you’ve come to expect. Call, click or stop by today to learn more.

What I Wish I Learned in School 5 of 12: The Importance of an Emergency Fund

Everyone knows it’s important to create and stick to a budget, but many people neglect to plan for the unexpected. Without proper planning, any surprise life event can send you spiraling into long-term debt.

The best way to plan for these events is by building an emergency fund for just this purpose.

Let’s take a closer look at why an emergency fund is so important and how to begin building your own.

Why is an emergency fund essential?

- Financial security. Unexpected expenses can arise at any time. An emergency fund provides the financial buffer needed to handle these surprises without throwing off your financial stability.

- Debt prevention. Having savings set aside can help you avoid resorting to debt when the unexpected happens.

- Less stress. Knowing there’s a financial cushion in place to help you navigate almost any financial reality, can help you sleep better at night. In addition, when an emergency strikes, the fund can help alleviate the financial anxiety typical of uncertain times.

Common uses for an emergency fund

- Job loss. An emergency fund ensures you can manage essential expenses while seeking new employment.

- Medical emergencies. Savings can help cover deductibles, treatments or medications that are not covered by insurance.

- Home or car repairs. An emergency fund allows for timely car and home repairs without financial strain.

How much should you save?

Financial experts typically recommend setting aside three to six months’ worth of living expenses in an emergency fund. However, the exact amount should be tweaked to individual circumstances.

Building your fund

Here are some tips for getting started on building your emergency fund today.

- Assess your expenses.

- Set realistic goals.

- Automate your savings with a monthly transfer to your savings account.

- Trim your spending.

- Use windfalls to boost your emergency fund.

Where to keep your emergency fund

Accessibility and safety are crucial when choosing where to store your emergency savings. High-yield savings accounts are often recommended due to their balance of liquidity and interest earnings. These accounts allow quick access to funds when needed while offering better returns than standard savings accounts.

Maintaining and replenishing your fund

It’s important that you use your emergency fund only for genuine emergencies. If you need to withdraw from it, prioritize replenishing the fund as soon as possible.

An emergency fund is more than just a financial safety net; it’s a foundation for long-term financial well-being. Build yours today!

What I Wish I Learned in School 4 of 12: Taxes Demystified

Taxes can seem daunting, especially when you’re just starting out. Here’s everything about taxes you wish you’d learned in school.

1. Taxes are inevitable

The first thing to know is that taxes are a part of life. Whether you’re earning a paycheck, running a business or investing, you’ll interact with the tax system. The key is to be informed and organized.

2. Your paycheck doesn’t show the whole picture

If you’ve ever wondered why your take-home pay is less than your salary, taxes are the answer. Employers withhold income taxes, Social Security and Medicare from your paycheck. This is called “pay-as-you-go” taxation.

Review your W-4 form when you start a new job or when your financial situation changes. This form determines how much federal income tax your employer withholds. Claiming too many allowances could lead to a big tax bill in April, while too few may mean you’re overpaying.

3. Tax deductions and credits are your friends

One of the most confusing aspects of taxes is the difference between deductions and credits:

- Deductions lower your taxable income, which reduces the amount of tax you owe.

- Credits are even better because they directly reduce the amount of tax you owe.

Learn which deductions and credits you qualify for.

4. Filing isn’t as scary as it seems

Gather all your important documents:

- W-2s from your employer(s)

- 1099s for freelance work or investment income

- Receipts for deductible expenses

- Records of charitable donations

Next, choose a filing method. You can use tax software or hire a professional.

5. Keeping records is crucial

The IRS recommends keeping tax-related documents for three years. This includes:

- Pay stubs

- Bank statements

- Tax returns

- Receipts for deductions

Keep these documents in a safe place for easy access.

6. Understand the difference between a refund and a bill

Getting a tax refund may feel like a bonus, but it means you paid more in taxes than you owed. On the flip side, owing taxes at the end of the year can be stressful. To avoid surprises, adjust your withholding or make estimated tax payments if you’re self-employed.

7. Retirement accounts offer tax advantages

It’s important to know how powerful retirement accounts are for saving on taxes. Contributions to traditional IRAs and 401(k)s are often tax-deductible, reducing your taxable income. Roth IRAs don’t offer an upfront deduction, but your withdrawals in retirement are tax-free.

Taking advantage of these accounts can help you build wealth while lowering your tax burden.

8. State taxes matter, too

Most states have income taxes, and each state has its own rules and rates. Research your state’s tax laws to avoid surprises and plan accordingly.

9. Deadlines are non-negotiable

The IRS tax filing deadline is typically April 15, but it may vary if on a weekend or holiday. Missing this deadline can result in penalties and interest on any taxes owed.

Use this guide to learn all about taxes.

6 Ways to Spring-Clean Your Savings

Time to get started on some spring cleaning! Remember to include your finances as part of your decluttering and tidying up. Well-organized money management can help you reach your saving goals. Here are six ways to spring clean your savings and make sure your financial goals are on track.

1. Organize your financial goals

Start by revisiting your financial goals. Have they changed since you last reviewed them? Refocusing your goals will help ensure your savings align with current needs and future aspirations.

2. Polish your savings accounts

Take a close look at your savings accounts. Evaluate the following:

- Interest rates. Consider switching to a high-yield savings account or a credit union account that’s offering better returns.

- Fees. Check for maintenance fees or minimum balance requirements. These can secretly erode your savings over time.

- Accessibility. Make sure you’re not keeping all your savings in accounts that are too easy to dip into.

If you’d like to change up your savings accounts, speak to an MSR at High Point FCU to learn which account may be better for your needs and goals.

3. Spruce up your budget

Give your budget a glow-up this spring. Here’s how:

- Track expenses. Review your spending habits and identify areas where you can cut back.

- Adjust categories. Tweak your categories to better reflect your current reality.

- Automate your savings. Set up automatic regular transfers from your checking account to your savings.

4. Clean up your subscriptions

Review your checking account statements or use a subscription-tracking app to identify recurring charges for services you no longer use. Canceling even a few subscriptions can free up some funds to give your savings a boost.

5. Make your emergency fund shine

No emergency fund? Or is your fund getting skimpy? Now’s the time to build it up. Aim for at least three to six months’ worth of living expenses to ensure you don’t need to dip into savings when the unexpected happens.

6. Dust off your debt

List your debts, including balances, interest rates and minimum payments. Then, choose a repayment strategy. You can go with the snowball method, in which you pay off the smallest debts first to build momentum, or with the avalanche method, in which you pay off the highest-interest debts first to save on interest.

As you declutter your home this spring, don’t forget to spruce up your savings, too! Use these tips to get started.

The 5 Golden Rules of Smart Money Habits Every Teen Should Know

Money is a big part of life, but it doesn’t have to be complicated. The earlier you learn how to handle it, the better off you’ll be in the future. Whether you’re saving for a cool gadget, your first car or just trying to make the most of your allowance, these five golden rules of smart money habits will set you up for success!

1. Spend less than you earn

It’s simple: If you spend more than you make, you’ll always be short on cash. Even if your earnings come from babysitting, mowing lawns or weekly allowances, it’s important to spend less than you earn.

Start by tracking what you earn and what you spend. If you’re spending too much on snacks or gaming subscriptions, look for ways to cut back. By keeping your expenses lower than your income, you’ll always have money for what matters most.

2. Save before you spend

Here’s a golden rule: pay yourself first! This means setting aside some of your money for savings before spending it on anything else. Even small amounts, like saving $5 out of $20, can add up over time.

Think of your savings as planting seeds. The more you plant, the more your money will grow, until you have enough to buy something you’ve always wanted.

3. Understand the power of compound interest

Compound interest is your BFF when it comes to growing money. Compound interest happens when your savings earn interest, and then that interest earns even more interest.

For example, if you put $100 in a savings account with a 5% annual interest rate, you’ll have $105 after a year. In the second year, you’ll earn interest on $105 instead of just $100. After a while, this adds up in a big way.

4. Know the difference between wants and needs

This rule can be tough, especially when there’s a new pair of sneakers or the latest video game calling your name. But learning to separate wants (things you’d like to have) from needs (things you must have, like food or school supplies) is essential.

When you get money, and you’re considering a purchase, ask yourself: “Do I really need this, or do I just want it?” It’s okay to spend on fun things sometimes, but make sure your needs are covered first—and try not to blow all your money in one go.

5. Set financial goals

What do you want to achieve with your money? Whether it’s saving for a concert ticket, a new phone or a long-term goal like college, setting clear goals will help you stay motivated.

Write down your goals and break them into steps. For example, if you need $200 for a gaming console, figure out how much you need to save each week to reach your goal by your deadline. Watching your savings grow is super satisfying!

So, next time you get your allowance or earn some cash, remember these tips. You’ve got the power to make your money work for you — starting today!

What I Wish I Learned in School 3 of 12: Credit Card Smarts

When it comes to life skills, managing credit cards is one of the most important lessons. But mastering the ins and outs of responsible credit card management can be the key to a lifetime of financial wellness. On the flipside, irresponsible credit card usage might trigger a downward spiral toward long-term debt and not being able to get larger loans later on. Here are the basic credit card smarts to know.

Understand how credit cards work

A credit card is a short-term loan. So, there is an expectation that you’ll pay it back — ideally on time and in full. Many first-time credit card owners don’t realize that paying only the minimum balance can lead to a lot of interest charges, and thus, make every purchase more expensive over time. Know the annual percentage rate (APR) on each of your credit cards and understand how interest accrues for times when you must carry a balance on your card.

Build credit early

Your credit score plays a pivotal role in your financial life. It can impact everything from your ability to rent an apartment to securing a car loan or even landing a job. It’s also super-important to start building your score as early as possible because the length of your credit history makes up a large percentage of your credit score. Paying your bill on time and keeping your credit utilization low are key factors in keeping a healthy credit score.

Use your credit card like a debit card

Credit cards make it easy to spend money you don’t have. As a teenager or college student, the temptation to swipe for meals, new clothes or gadgets is hard to overcome. It’s important to remember, though, that every swipe adds up. Losing track of your spending might bring a balance that’s difficult to pay off. Budgeting and tracking expenses are crucial habits to develop early on to avoid credit card debt.

Never miss a payment

Never miss a credit card payment, even if you can only afford to pay the minimum payment. Missing just one payment can have a bad impact on your credit score, in addition to late fees and penalty interest rates.

Understand rewards and perks

Credit cards often come with rewards programs, cash-back options and perks, like travel insurance or purchase protection. While these benefits can be valuable, they shouldn’t drive your spending. Make sure you weigh the potential costs of using your credit card for purchases before deciding to whip out the plastic.

Avoid credit card traps

Credit card companies don’t always make their terms crystal clear, and that’s no accident. Before signing up for a new credit card, read the fine print. For example, an enticing 0% APR offer might revert to a much higher rate after the promotional period.

Learn about credit utilization and its impact

Credit utilization refers to the ratio of your credit card balance to your credit limit. This percentage significantly impacts your credit score. It’s best to keep your credit utilization (across all your cards) below 30%.

Use these tips to learn how to manage your credit cards responsibly.

High Point Federal Credit Union’s Bradford Branch slated to open March 17th

High Point Federal Credit Union’s newest branch office, located at 1035 East Main Street in Foster Brook, is set to open Monday, March 17, 2025. The new full-service branch will provide loan, teller, and membership services, along with two drive-thru Interactive Teller Machines (ITMs).

To celebrate the grand opening, High Point FCU will host a range of promotions during March, April, and May. These promotions will feature specials for new members, as well as offers on auto, personal, and home loans, along with a certificate special.

The open design of the new building reflects the credit union’s dedication to fostering relationships and enhancing the member banking experience. This branch will include open teller stations, private offices, and a consultation area. The thoughtful design and strategic location aim to deepen engagement with members across McKean County and demonstrate a commitment to investing in the local community

High Point Federal Credit Union is the 2nd largest credit union in Western New York, with assets over $400 million. The credit union currently serves over 22,000 members with four locations in Cattaraugus County, NY, 1201 Wayne Street and 206 North Clark Street in Olean, and 180 West Main Street in Allegany and 160 South Main Street in Portville.

How to Set SMART Financial Goals (and Actually Reach Them!)

Setting goals for your money might sound boring, but it’s like creating a game plan to get what you want and feel awesome while doing it. Whether you’re saving for new sneakers, a new phone or your future, using the SMART goals system can help you get there. SMART goals aren’t just “smart” (like genius-level smart)—it’s a simple way to make your goals clear and achievable. Let’s break it down!

What are SMART goals?

SMART stands for:

S – Specific

M – Measurable

A – Achievable

R – Relevant

T – Time-bound

These five steps will turn any big idea into a goal you can actually reach. Let’s see how it works!

1. S is for Specific

First, make your goal as clear as possible. Don’t just say, “I want to save money.” Instead, get specific, like: “I want to save $50 for a pair of headphones.” Being specific helps you know exactly what you’re working toward.

2. M is for Measurable

You need to know when you’ve hit your goal, so give it a number you can measure. In this case, your goal would be to save $50. You can track your progress—$10, $20, $30 … all the way to $50!

3. A is for Achievable

Make sure your goal is realistic. Can you really save $50 in a few weeks? To find out, check how much you earn from allowances, chores or part-time work. If you earn $10 a week, and can put all your earnings into savings, saving $50 is possible in 5 weeks. If that feels too long, think about smaller goals—like saving $20 first.

4. R is for Relevant

Is this goal important to you? Saving for something you care about makes it easier to stick to your plan. Ask yourself: Why do I want these headphones? Will they make me happy? If the answer to the second question is yes, you’ve got a goal worth chasing!

5. T is for Time-bound

Set a deadline for your goal. Deadlines keep you on track and give you something to target. For example: “I’ll save $50 in 5 weeks.” Now you have a finish line — and a game plan!

How to reach your SMART goals

Here are some tips to make it easier:

- Break it down: If saving $50 feels big, focus on saving $10 at a time.

- Track progress: Use a savings chart or a jar to see your money grow.

- Cut back on spending: Skip small things like snacks or apps to save faster.

- Earn more: Ask for extra chores or find ways to make money (like walking a neighbor’s dog).

Setting SMART financial goals is like creating a map for your money. By being Specific, Measurable, Achievable, Relevant, and Time-bound, you’ll know exactly what you’re saving for, how to do it and when you’ll get there. Start small and stay focused—you’ve got this!

Beware of AI Scams!

From revolutionizing industries, like healthcare and finance, to replacing jobs in publishing and graphics, Artificial intelligence (AI) is changing the world. Unfortunately, scammers are also using AI to con victims out of their money and personal info. Here’s what you need to know about AI scams and how to protect yourself.

Types of AI scams

AI scams come in many forms. Here are some of the more common.

- Deepfake scams. In these scams, fraudsters use AI to create realistic videos or audio clips, often mimicking real people. Scammers use deepfakes to impersonate business executives, family members, political figures or celebrities to trick people into transferring money or revealing sensitive information.

- AI-powered phishing emails. Scammers use AI to craft personalized and convincing emails that mimic legitimate organizations. These emails often contain fake links or attachments designed to steal personal or financial information.

- Chatbot impersonation. Here, scammers deploy AI-driven chatbots to impersonate customer service representatives or company officials. These bots engage in real-time conversations, persuading victims to share sensitive information or make payments.

- AI voice cloning. This uses AI to replicate someone’s voice, typically a family member or close contact. Scammers use this cloned voice in phone calls to request urgent financial help.

- Job offer scams. In these scams, fraudsters use AI to scrape data from job boards and LinkedIn profiles before targeting job seekers with fake offers. They use automated systems to conduct interviews and request upfront fees.

How to spot AI scams

Don’t get caught in an AI scam! Here’s how to spot one:

- Unusual requests for urgency. If someone is demanding immediate action, such as transferring money, pause to verify authenticity.

- Inconsistencies in communication. Check for inconsistencies in tone, grammar or details that don’t align with the purported sender’s usual style.

- Requests for personal information. Legitimate organizations rarely ask for sensitive information, like passwords, Social Security numbers or credit card details, by email, text or phone call.

- Unverified sources. If you get communication from a new email address, phone number or chatbot, cross-check it with official contact details found on the organization’s website.

How to protect yourself

- Verify before you act. Always double-check any request for money or personal details.

- Strengthen cybersecurity. Use strong, unique passwords and enable multi-factor authentication (MFA) for your accounts. Keep your software and devices updated to protect against vulnerabilities.

- Be cautious with AI tools. Avoid sharing sensitive information with AI tools or chatbots unless you are certain of their legitimacy and security.

- Educate yourself and others. Stay informed about the latest AI scams and share your knowledge with others.

- Monitor your accounts. Regularly check your account and credit card statements for unauthorized transactions.

- Use anti-scam technology. Install reliable antivirus software and consider tools specifically designed to detect and block phishing attempts or deepfake content.

- Report suspicious activity. If you encounter an AI scam, report it to local authorities, the Federal Trade Commission (FTC) and/or other relevant organizations.

Stay safe!